Ahead of the GST council meeting on 17December , Lakshmikumaran and Sridharan (LKS), a premier full-service Indian law firm specialising in taxation, in a detailed whitepaper has showcased international best practices in GST for online gaming. According to the report, most countries with a thriving online gaming industry follow a ‘Tax on Gross Gaming Revenue (GGR)’ model. It also cites examples of countries where high taxation and /or incorrect levy on the contest entry amount (CEA) led to revenue loss for the Government and encouraged the growth of the unauthorised offshore betting and gambling platforms.

In India, the online gaming industry currently pays GST at the rate of 18 per cent on GGR amounting to over Rs 2,200 crore per year. The report comes at a time when the Group of Ministers’ panel on Casinos, Race Courses and Online Gaming (GoM) is likely to recommend a GST levy of 28 per cent on online gaming, irrespective of whether it is a game of skill or chance, and may leave the final decision on the calculation method to the GST Council. The GoM panel had earlier recommended a levy of 28per cent on CEA for the online gaming industry, which may make the industry unviable.

Commenting on the report, LKS executive partner L Badri Narayanan said, “Countries globally are adopting progressive tax practices that benefit both the industry and the Government. Through our research, we found out that the ‘Tax on GGR’ model for online gaming provides the most efficient, win-win arrangement – that allows the industry to grow in a responsible manner while also adding revenues for the exchequer.”

He added, “In India, a departure from international best practices will not only blur the well-established variance between games of skill and games of chance, but also eventually lead to value erosion for more than 500+ Indian start-ups currently valued over $20 billion, which have attracted more than $ 2.5 billion in investments and FDI. A prudent taxation regime for the sector will plug the potential of revenue leakage and funding of illicit activities while supporting the growth of India’s digital economy ambitions.”

The report also highlights important case studies from the UK and France and recommends that it must be considered by the GST Council. Earlier, the UK was levying 6.75per cent on CEA. However, it soon shifted to 15 per cent GST on GGR as the earlier tax model was causing the movement of bookmakers to offshore tax havens, leading to a loss of revenue for the government. The report, further, noted that the shift from turnover tax at the rate of 7per cent to GGR at 15 per cent in the UK led to new investments and created employment opportunities.

France, one of the largest nations by GDP that has regulated online gaming, was following the model of taxing on CEA. However, in 2020, the French Senate proposed a Budget Bill to amend the tax model from CEA to GGR with respect to the calculation of tax on gaming, as it realised that the industry was being unfairly taxed on money that wasn’t their revenue.

The report observes that the proposed increment in tax structure from 18 per cent on GGR to 28per cent on CEA will increase the tax liability for gaming companies by more than 1455 per cent of the current amount, closing the curtains on legitimate operators, and giving rise to proliferation of illegal offshore operators. As global markets unilaterally move to the GGR model, the report affirms that India needs to consider sustainable international practices and favour progressive laws over a prohibitive taxation regime to realize the collective vision of a ‘Digital India’.

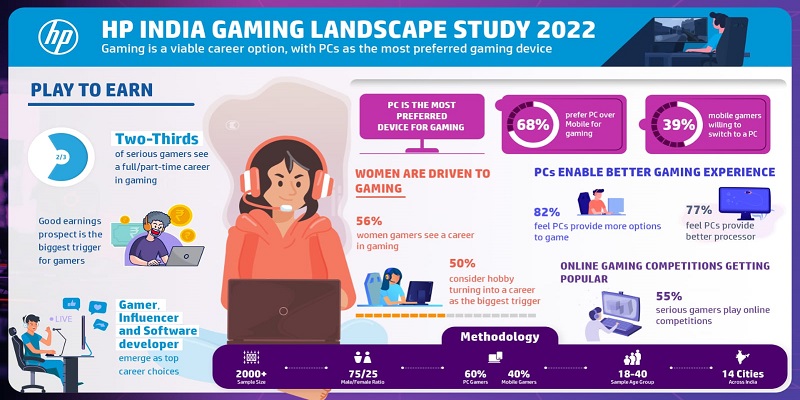

Currently, India has over 950 gaming companies and more than 500 online skill gaming start-ups with at least 15,000 game developers with the potential to create 1.6 lakh skilled workforce. With over Rs 20,000 crore in FDI, the industry boasts of one listed company, three unicorns and hundreds of ‘soonicorns’. Further, the Supreme Court of India and multiple High Courts, have consistently held online skill gaming to be distinct from gambling and betting, opining the former to be a legitimate business activity protected under Article 19 (1) (g) of the Constitution of India.