APAC hosts 40 per cent Web3 game developers in the world, as per the State of Web3 Gaming report. The report is published by Game7, a community dedicated to accelerating the adoption of blockchain technology in gaming. The report was conducted independently to provide an in-depth analysis of the burgeoning Web3 gaming sector, revealing essential data trends, and insights for industry professionals.

State of Web3 Gaming offers a comprehensive view of key ecosystem metrics that have evolved over the past six years. Through rigorous primary research methods, Game7 has captured, examined, and fingerprinted data from more than 1,900 blockchain games,1,000 funding rounds, and 170 blockchain ecosystems.

Delving into the industry’s many facets, encompassing the Web3 gaming stack, gameplay trends, blockchain networks, competitive dynamics, and fundraising, the report sheds light on the evolution of Web3 gaming following the 2022 market correction. The report serves as essential reading for game developers, investors, blockchain enthusiasts, and anyone keen on understanding the future trajectory of the Web3 gaming space.

1. APAC leads Web3 game development, USA maintains momentum

- APAC hosts the majority of Web3 game developers (40 per cent), followed by North America (30 per cent). This year, half of the new games entering the space were based in Asia.

- This year, 30 per cent of new Web3 gaming teams came from the USA, while South Korea contributed to 27 per cent of Web3 gaming teams, almost doubling its contribution from last year.

- The USA remains the largest market for Web3 game developers (30 per cent). Other key markets include South Korea (12 per cent), the UK (6 per cent), Singapore (6 per cent), Vietnam (4 per cent), and Australia (4 per cent).

2. Web3 gaming investments defy post-correction slowdown:

- Investment in the Web3 gaming sector saw a massive surge in 2021 and stabilised in 2023, reminiscent of pre-bull market levels. Since 2018, a staggering $19B has been funneled into Web3 gaming-related projects.

- The Web3 gaming market continues to grow, albeit slower after the 2022 market correction. Until Q3, blockchain gaming-related rounds reached $1.5B in 2023, with more than $800M being exclusive to Web3 gaming, while the rest was shared across multiple verticals. US-based Web3 gaming projects have attracted more than $4B in funding, with France ($0.9B), Canada ($0.67B), Singapore ($0.67B), and Hong Kong ($0.66B) to follow.

- Sports ($1B), MMOs ($1B), RPG ($0.7B), and Action ($0.3B) game genres have attracted the most funding since 2018.

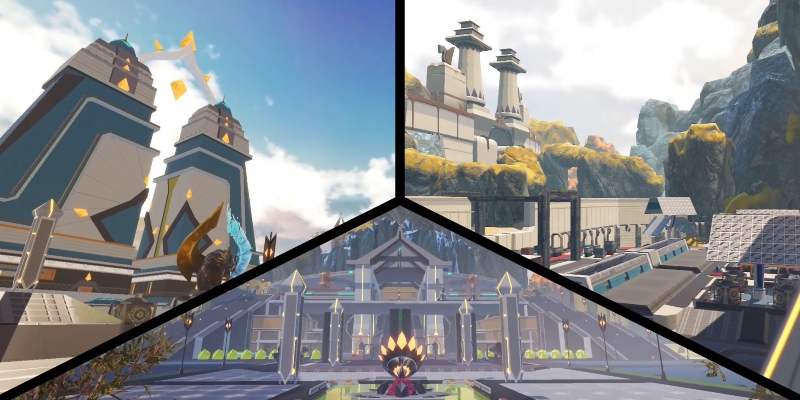

3. The reality of AAA Web3 Games:

- The Web3 gaming ecosystem is chiefly composed of indie-level and midsize projects, making up 94 per cent of the market. Meanwhile, AA & AAA titles are relatively scarce, contributing to only 6 per cent of the market share.

- RPG, Action, Strategy, and Casual games are the most commonly developed genres, with platform-specific preferences revealing RPG and Action as popular on PC, a balanced mix on mobile, and Casual games leading in browser-based games.

- Most Web3 games are Free-to-play (F2P) (69 per cent), while 26 per cent of the current titles require players to hold specific NFTs to access the game.

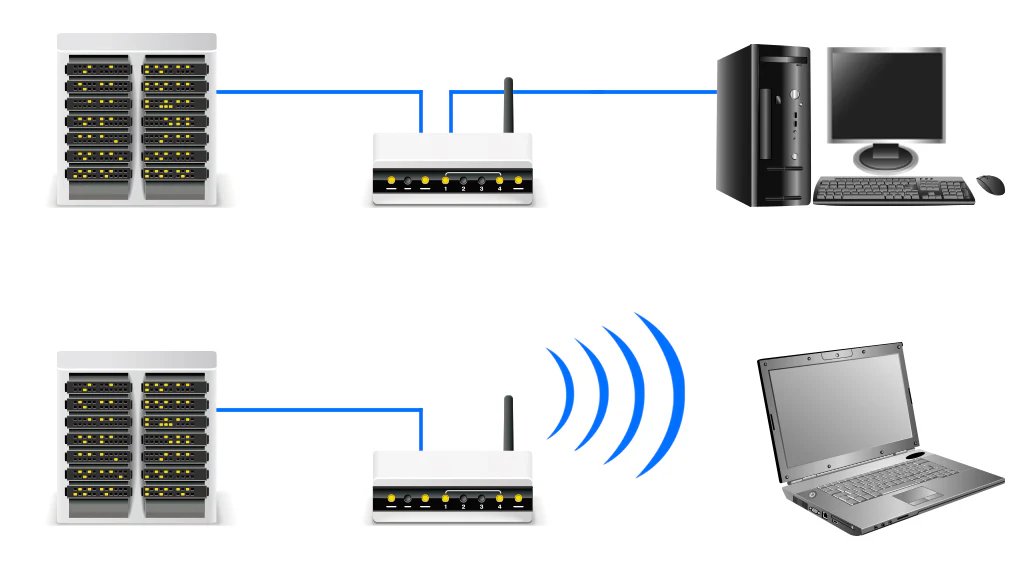

4. Despite unfavorable market conditions, Blockchains targeting the gaming sector are on the rise

- In 2023, more than 81 new blockchain networks that target gaming were announced, growing by 40 per cent YoY.

- The majority of Web3 games (81 per cent) are using general-use L1 networks, with EVM sidechains marking a significant portion. L1 networks remained the clear preference for most games launched this year (75 per cent). On the contrary, 51 per cent of new networks were either a L2 (42 per cent) or L3 (9 per cent), mainly driven by the rise of Optimistic L2/L3 solutions.

- Application-specific networks, a new breed of blockchain networks for gaming, accounted for 43 per cent of the newly launched networks this year, growing 84 per cent YoY.

5. Distribution remains a strategic challenge for the Web3 Gaming Stack

- Today, six out of 10 Web3 games are excluded from mainstream distribution platforms and depend on direct channels or Web3 native platforms for distribution.

- The Epic Games store has increasingly embraced Web3 games, going from only two games listed in June 2022 to 69 in October 2023.

- Unity and Unreal Engine command an overwhelming majority (95 per cent) in Web3 PC game development.

- Most Web3 games (85 per cent) use blockchain technology to tokenise fungible and non-fungible assets while keeping the game state and logic off-chain. Only 5 per cent of the total game population is Fully-on-chain.

6. Blockchain wars in full swing for Web3 gaming

- In 2023, an all-time high number of Web3 games migrated to different networks, with Polygon, Immutable, and Arbitrum being favoured destinations.

- The Polygon ecosystem hosts most Web3 games today, followed by BNB and the Ethereum Mainnet.

- Immutable has emerged as the most popular L2 gaming ecosystem, followed by Arbitrum. Solana remains the largest non-EVM ecosystem of Web3 games.

- OP Stack is the leading choice among blockchain frameworks for the creation of new networks aiming at gaming use cases.

Game 7 core contributor George Isichos, who spearheaded the report, commented, “In the nascent realm of Web3 gaming, better research is how we solve complex problems. This report is our first attempt to index and better understand the broader Web3 gaming ecosystem in a credibly neutral manner, putting core game development pains ahead of tokens and speculation.”

“Challenges can only be met with trustworthy information,” said Game 7 core contributor Steven Chen. “Research that is objective, transparent, and clear empowers game developers to make better, more accurate decisions during their development phase. Our intent is to make this research available to everyone so that anyone in Web3 gaming can benefit from it.”

A full copy of the report can be found on Game7’s website.