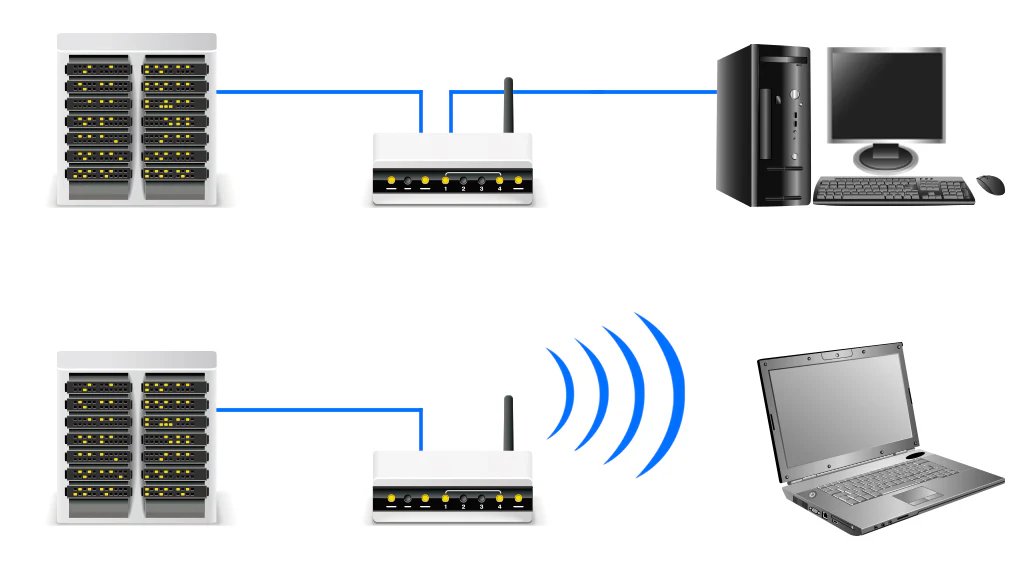

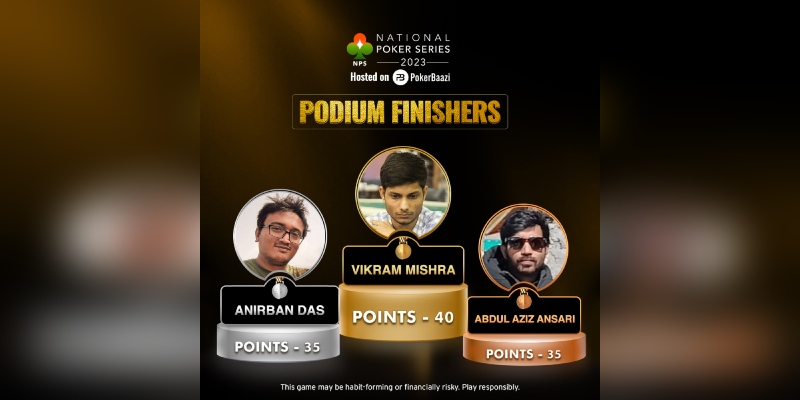

Online gaming companies in India have always been on the government’s radar due to the nature of real money gaming (RMG). While the companies claim that the games are based on skill, other parties have contested saying that these games come under gambling. Now in the latest development, India’s tax officials are set to investigate over 100 online gaming companies for their potential evasion of GST, suggest reports.

The news comes closely after India’s tax authority DGGI (Directorate General of GST Intelligence) issued an intimation notice to Bengaluru-based online gaming company Gameskraft, for tax evasion of Rs 21,000 crores.

As per reports, a senior DGGI official said, “There are over 100 companies registered domestically with online gaming federations. We will start looking into the activities of these companies to check whether there has been any evasion of GST.” The official, however, clarified that only the firms that offer real money and include a money element in their gaming will be thoroughly investigated.

The DGGI has recently handed a GST notice of Rs 16,822 crores to casino operator Delta Corp which is listed as a gaming and hospitality company. This is the second GST notice to Delta Corp after the first one, which amounted to Rs 11,139 crores. As per the Business Today report, DGGI is already investigating 35-40 online gaming companies and is set to issue them GST evasion notices.

In the case of Gameskraft, the Karnataka High Court had rejected the issuance of the intimation notice to the gaming company. This order was later stayed by the Supreme Court. Gameskraft then stated that along with the skilled gaming industry associations, it will put forth its submissions before the Supreme Court.

In August this year, the government stated that a 28 per cent tax will be applied to the full value of bets placed on online games from 1 October, and that the policy may be reconsidered after a six-month implementation period.

Now, we are to see which other online gaming platforms receive intimation notices from DGGI, and what action the courts take subsequently.

AnimationXpress closely follows the gaming industry. Stay posted for the latest updates in this case.