Recently, Chinese regulators implemented a comprehensive set of regulations targeting spending and incentives that fuel excessive gameplay in video games. These regulations have wielded a significant impact on the gaming industry, notably affecting Tencent, a leading Chinese tech conglomerate that holds a pivotal position in global gaming. Notably, it’s been reported that Tencent lost about a staggering $54 billion owing to China’s latest gaming restrictions.

The latest regulations mandate spending limits in online games as drafted by the National Press and Publication Administration (NPPA). NPPA is China’s sole game regulatory authority which approves games and regulates the market. According to draft rules published on 22 December 2023 by NPPA, online games must not offer rewards that tempt people to excessively play and spend, it includes those for daily logins and topping up game accounts with additional funds.

The NPPA mandates that all video games must limit the amount of money that users can add to their game accounts and notify gamers through a pop-up window of “irrational consumption behaviour”.

As per NPPA, the draft rules are aimed to standardise the order of the online game industry, protect the legitimate rights and interests of users, protect the physical and mental health of minors, and promote the healthy and orderly development of the online game industry.

The proposed legislation is the first time that China has taken a focused approach to the video gaming industry since Beijing increased its monitoring of this industry in late 2021 as part of a larger campaign against the nation’s big tech corporations.

Regulators imposed stringent limitations on children’s gaming time in 2021, capping it at three hours per week. Additionally, officials halted the approval of new video games for around eight months, only to resume in April 2022 when they softened their crackdown on the technological sector as a whole.

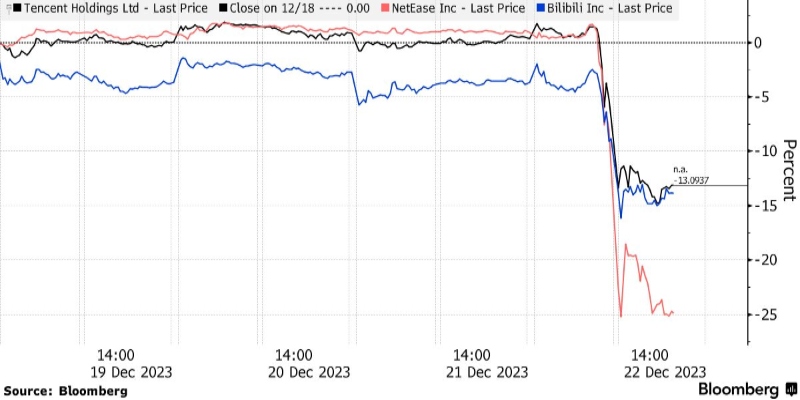

As per reports, Tencent had its worst intraday fall since 2008 during Friday’s market sell-off, approximately falling by 16 per cent, NetEase Games plunged by 25 per cent, whereas Bilibili took a 14 per cent dive.

When questioned about the implications of the draft rules, Tencent Games vice president Vigo Zhang told Reuters that Tencent will not need to fundamentally change “its reasonable business model or operations” for games, adding that the company has been strictly implementing regulatory requirements.

Zhang added that minors had been spending a historically low level of money and time on Tencent’s games since 2021 when minor protection became a focus for Beijing.

“The government gaming curb measures will hurt gaming companies’ earnings,” said Shanghai Junniu Private Fund Management fund manager Yang Junxuan to Bloomberg. Junxuan went on to highlight the broader concerns people have, like fears of further measures targeting the sector, similar to the actions taken against the education sector, a few years ago.

However, among the new rules is a proposal widely anticipated to be embraced by the industry: a requirement for regulators to process game approvals within a 60-day timeframe.

Simultaneously, on the same day, Chinese regulators announced the issuance of licences for 40 new imported games for domestic releases. This move is perceived as a signal of Beijing’s inclination to permit more games within the country, despite the draft rules concerning game spending.