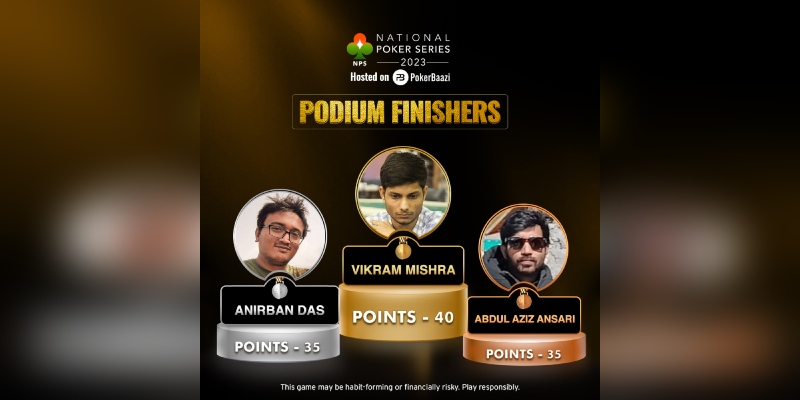

Minister of state Rajeev Chandrasekhar stated at an event on Monday that the nodal ministry for regulating online gaming, the Ministry of Electronics and IT, will ask the GST Council to reconsider its decision of implementing 28 per cent tax on online gaming after the regulatory framework for the rules related to online gaming develops.

Chandrasekhar said, “We are only in the nascent stages of creating a sustainable, permissible online gaming framework. So, we will do that and go back to the GST Council and maybe request their consideration on the new regulatory framework.”

On 11 July, the GST Council announced that the government will levy a 28 per cent goods and service tax on the turnover of online gaming companies, horse racing and casinos.

“GST Council is not the Government of India. The council is represented by all state governments. It is a federal organisation,” he added. “State governments and finance ministers have come together and created a GST framework. That is a consequence of three years of their work. While we may quibble with the findings, we have to recognise the process of creating a framework, which started in January 2023.”

Reacting to the industry’s take on GST Council’s announcement, Chandrasekhar argued, “It is better to slowly progress and evolve these frameworks that are sustainable than doing things in a hurry just because you’re reacting to a sound byte or to an angry industry, or an angry start-up, and then create downstream mistakes.”

GST Council’s decision has made the online gaming industry furious and tense. The industry has appealed to the Ministry of Information and Technology (MeitY) to impose tax on only gross revenues, through a letter.