The Web3 gaming market size is projected to be worth US$23,926.0 million in 2023. The market is likely to surpass US$133,228.2 million by 2033 at a CAGR of 18.7 per cent during the forecast period.

The demand for Web3 gaming is driven by several factors.

Drivers propelling the demand for Web3 gaming include:

- The demand for decentralised technologies, such as blockchain, is increasing as individuals seek greater control and ownership over their digital assets.

- The opportunity to earn real-world value through gameplay incentivises players to participate in Web3 gaming, driving demand.

- The ability to use in-game assets across multiple games and platforms provides players with flexibility and a seamless gaming experience.

- Active player involvement in the development process fosters a sense of ownership, loyalty, and engagement.

Challenges for companies/manufacturers in the Web3 gaming market:

- Web3 gaming introduces new technologies and concepts that may be unfamiliar to some players, leading to a learning curve and potential barriers to adoption.

- The scalability of blockchain technology and infrastructure may pose challenges in handling large-scale gaming operations, resulting in potential limitations or performance issues.

- The use of cryptocurrencies and NFTs in Web3 gaming may involve transaction fees and initial costs, which could deter some players or limit accessibility.

Opportunities in the Web3 gaming industry:

- Web3 gaming opens up new avenues for revenue generation, such as through the sale of in-game assets, marketplaces, and services related to the play-to-earn model.

- As Web3 gaming gains traction, it presents opportunities to tap into emerging markets, particularly in regions with a growing interest in cryptocurrencies and blockchain technology.

- Web3 gaming allows for innovative gameplay mechanics and unique experiences, enabling developers to differentiate their offerings in a competitive market.

- Collaboration between gaming companies, blockchain developers, and crypto projects can drive innovation, expand market reach, and foster cross-pollination of ideas and technologies.

Latest trends in the Web3 gaming market:

- Traditional gaming platforms and companies may adapt and integrate Web3 elements, posing competition to Web3 gaming and potentially diverting attention from fully decentralised experiences.

- Uncertain or restrictive regulations on cryptocurrencies and blockchain technology may limit the growth and adoption of Web3 gaming.

- The scalability, speed, and costs associated with blockchain technology may present technological barriers that need to be overcome for widespread adoption.

- The volatility of cryptocurrencies and digital assets can impact the perceived value of in-game assets and the overall stability of the market, potentially affecting user confidence.

2018 to 2022 Web3 gaming demand outlook compared to 2023 to 2033 forecast

From 2018 to 2022, the global Web3 gaming market experienced a CAGR of 17.0 per cent, reaching a market size of US$23,926.0 million in 2023.

From 2018 to 2022, a growing interest and adoption of Web3 gaming concepts is driven by the factors mentioned earlier such as decentralisation, play-to-earn, and community engagement.

The development and release of blockchain-based games, the rise of NFTs, and the expansion of decentralised finance (DeFi) have contributed to the increased attention and demand for Web3 gaming during this period.

Looking ahead, it is reasonable to expect continued growth and maturation of the Web3 gaming market. As blockchain technology improves, scalability issues are addressed, and regulatory frameworks become more defined, it could pave the way for broader adoption and increased demand. Moreover, as more players become aware of the potential for earning and owning digital assets through gameplay, it could drive further interest in Web3 gaming.

Future forecast for Web3 gaming industry

- Looking ahead, the global Web3 gaming industry is expected to rise at a CAGR of 18.7 per cent from 2023 to 2033. During the forecast period, the market size is expected to reach US$ 133,228.2 million.

- The Web3 gaming industry has the potential to see increased mainstream adoption as blockchain technology becomes more accessible and user-friendly. Developers may explore innovative ways to incorporate blockchain technology, non-fungible tokens (NFTs), and play-to-earn mechanics into different game experiences, appealing to a broader audience.

- Scalability has been a challenge for blockchain technology, but ongoing research and development efforts are focused on enhancing scalability solutions.

- Interoperability between different blockchain and gaming ecosystems may improve, enabling seamless asset transfers and cross-game compatibility. Regulatory frameworks governing cryptocurrencies, NFTs, and blockchain technology are likely to develop.

- Integration with virtual reality (VR) and augmented reality (AR) technologies could create immersive and interactive experiences. Partnerships and collaborations between traditional gaming companies, blockchain startups, and technology giants could lead to the integration of Web3 elements into existing gaming platforms.

- Social and community features: Web3 gaming platforms may focus on enhancing social and community features, fostering player interactions, and creating virtual economies.

Country-wise insights

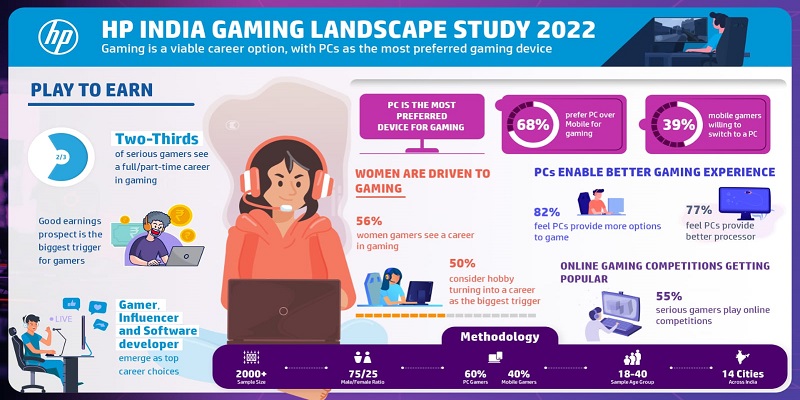

India is a fast-growing web gaming market, driven by a large youth population, smartphone adoption, and affordable internet access

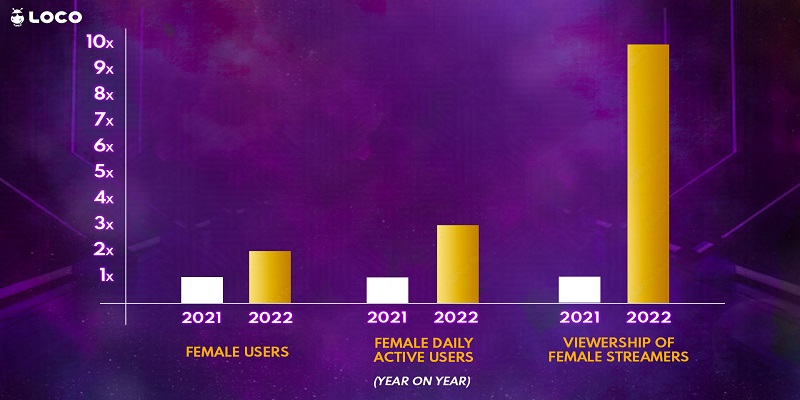

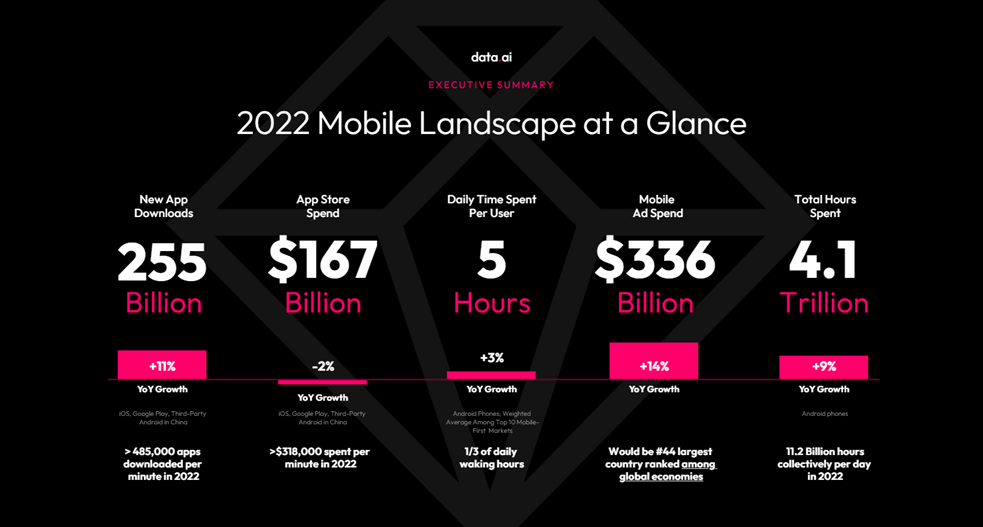

The Web3 gaming market in India is expected to reach a market share of US$ 8,260.1 million, expanding at a CAGR of 8.3 per cent during the forecast period. India is one of the fastest-growing web gaming markets, driven by a large youth population, increasing smartphone adoption, and affordable internet access. Mobile gaming dominates the market, with casual games, multiplayer experiences, and online battle royale games gaining traction. India has a burgeoning esports scene, with tournaments, streaming platforms, and professional players. Localisation plays a key role in the market, with games tailored to suit local preferences, languages, and cultural elements.

USA is a hub for web gaming industry growth due to its high internet penetration, technological advancements, and large population of gamers

The web3 gaming industry in USA is expected to reach a market share of US$ 14,255.4 million by 2033, expanding at a CAGR of 13.3 per cent. The country has a well-established web gaming market, driven by internet penetration, technological advancements, and a large population of gamers. The popularity of consoles, PCs, and mobile devices contributes to a diverse gaming landscape, with a focus on online multiplayer games, e-sports, and streaming platforms.

The presence of major gaming companies, developers, and publishers in the country fuels innovation and attracts investments, making USA a hub for web gaming industry growth. Apart from a large gaming population, the people in the USA have also grown familiar with the applications of blockchain technology such as cryptocurrency and NFTs, allowing rapid adoption of Web4 gaming in this country because of familiarity with the technology.

The United Kingdom has a thriving web gaming market, mobile gaming, e-sports, and a robust ecosystem of game development talent

The web3 gaming industry in the United Kingdom is expected to reach a market share of US$7,061 million, expanding at a CAGR of 10.2 per cent during the forecast period. The UK has a mature and thriving web gaming market, characterised by a tech-savvy population and high internet connectivity. Mobile gaming is particularly popular, with a focus on casual and social gaming experiences. The country has a vibrant e-sports scene, hosting major tournaments and events, and fosters a supportive environment for indie game development.

The market also benefits from a strong presence of game studios, publishers, and a robust ecosystem of game development talent, allowing the growth and adoption of the Web3 gaming market in the United Kingdom over the forecast period.

China has great potential for growth of the Web3 gaming market, however, it has potential challenges in the initial phase

Till now China has not permitted the use of cryptocurrency and mining in the country however quite recently Hong Kong has enabled the use of cryptocurrency for retail purposes.

This shows, that although slow the use of cryptocurrency in China can indeed grow in the future so, while Web3 games may not be able to generate revenue from cryptocurrency for in-game purchases initially there is indeed a future where revenue can be generated, however, there is a great possibility considering the stand that China had taken and the restrictions it has upon various cryptocurrencies, that the cryptocurrency used will be created or authorised by the Chinese themselves.

There is potential for Web3 gaming in China though since the government has expressed an openness towards the possibilities that could be made possible through Web3.0. Due to these reasons, the Chinese market for Web3 gaming is estimated to grow at a CAGR of 16.3 per cent over the forecast period.

Japan has a unique web gaming market with a long history of console, mobile, and arcade ulture

The web3 gaming industry in Japan is estimated to reach a market share of US$10,791.4 million by 2033, thriving at a CAGR of 15.5 per cent. Japan has a unique web gaming market with a long history of console gaming, mobile gaming and arcade culture. Mobile gaming is popular with RPGs, gacha games, and social gaming experiences. Japan also has a dedicated esports scene, hosting tournaments, attracting professional players, and fostering a passionate gaming community.

Another thing that needs to be considered for the Japanese markets, is that it isn’t only the videogames that have hooked the consumers, but also the storylines and the world which the video games follow and are based upon, a great example of this is the Pokemon franchise which is one of the most successful videogame franchises in Japan and has been operating since 1996, Pokemon is just one of many other videogames, that has hooked consumers for a long time. Franchises like these have a great chance of attracting consumers towards Web3 gaming which will be a much new concept for the majority of the gaming population.

Category-wise insights

Windows is leading the end-user segment due to its long-standing market dominance, widespread hardware compatibility, software ecosystem, and enterprise adoption

Windows is expected to dominate the Web3 gaming industry with a market share of 35.2 per cent from 2022 to 2033.

Windows has been leading the end-user segment of the market for several reasons: long-standing market dominance, wide hardware compatibility, software ecosystem, and enterprise adoption. Windows has a strong history of delivering reliable and feature-rich operating systems that have become the default choice for many users and businesses. It has achieved widespread hardware compatibility, allowing it to run on a vast array of devices from various manufacturers.

It has a vast software ecosystem, including a wide range of applications, productivity tools, and games. It has been the preferred choice for many businesses and enterprises worldwide, offering robust security features, centralised management capabilities, and compatibility with a wide range of business applications. Windows has a large user base, and many individuals have grown up using it as their primary operating system.

Microsoft consistently invests in research and development to enhance the Windows operating system and offers robust development tools, resources, and support for software developers. This support encourages the creation of a wide range of applications and software for the Windows platform, ensuring a rich ecosystem and providing users with access to the latest software innovations. While Windows continues to dominate the end-user segment, the landscape is evolving, but its long-established market position, compatibility, software ecosystem, and user familiarity contribute to its leadership in the end-user segment.

Demand for Ethereum as in-game payments in the Web3 game market is likely to increase due to its security, speed, and cost-effectiveness

Ethereum is expected to dominate the Web3 gaming industry with a CAGR of 16.2 per cent from 2022 to 2033.

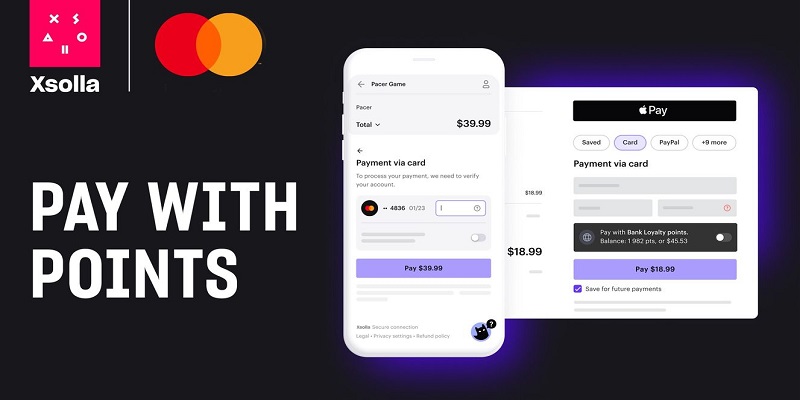

The demand for Ethereum as in-game payments in the Web3 game market is driven by the rise of blockchain gaming, the need for a more secure and transparent payment system, and the potential for greater monetisation.

Blockchain games offer the potential for greater monetisation than traditional games, as players can own their in-game assets and trade them with other players, creating a secondary market for in-game assets. As the Web3 game market continues to grow, the demand for Ethereum as in-game payments is likely to increase due to its advantages over traditional payment systems, such as security, speed, and cost-effectiveness.

Several other factors could drive demand for Ethereum as in-game payments in the Web3 game market. The demand for Ethereum as in-game payments in the Web3 game market is likely to continue to grow in the coming years due to several factors, including the rise of blockchain gaming, the need for a more secure and transparent payment system, and the potential for greater monetisation.

Non-fungible tokens (NFTs) are digital assets that are unique and cannot be replaced. As the popularity of NFTs continues to grow, so will the demand for Ethereum. New gaming platforms are being developed that are built on blockchain technology, offering features such as the ability to own and trade in-game assets.

How do key players stay competitive in the Web3 gaming industry?

The Web3 Gaming industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key strategies adopted by the players:

- Product Innovation

Leading Web3 gaming companies focus on developing innovative gameplay mechanics that leverage blockchain and decentralised technologies. They explore new ways to integrate NFTs, play-to-earn models, metaverse concepts, and community-driven mechanics to create unique and engaging experiences for players.

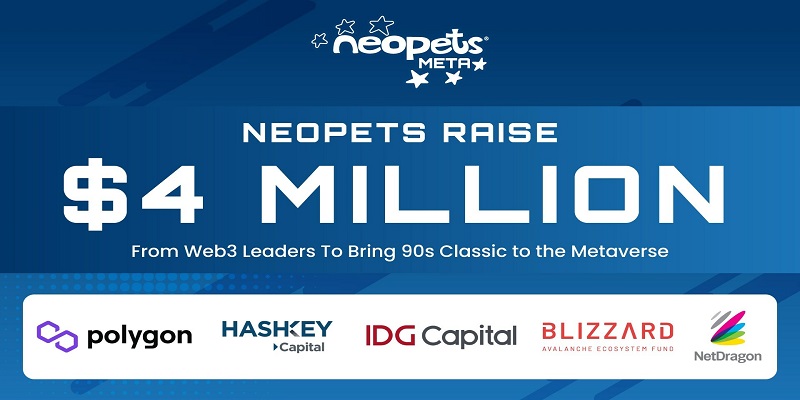

- Strategic Partnerships and Collaborations

Strategic collaborations with blockchain projects, crypto platforms, and DeFi protocols allow key players to tap into the wider Web3 ecosystem. Integrating with existing decentralised infrastructure, interoperability protocols, and cross-chain solutions enables them to leverage the strengths of different projects, expand their reach, and provide enhanced experiences for their players.

- Expansion into Emerging Markets

Companies recognise the significance of localising their games and platforms to adapt to the interests and cultural idiosyncrasies of certain expanding countries. This includes translating game material and interfaces into local languages, including local themes and allusions, and modifying gameplay mechanics to the tastes of the target market.

- Mergers and Acquisitions

Companies may purchase smaller studios or teams to gain access to specialised skills in web3 gaming. This can help them strengthen their internal capabilities in areas like blockchain development, decentralised finance (DeFi), non-fungible tokens (NFTs), and virtual reality (VR). Acquiring talent can help a company’s innovation and position in the continually changing web3 gaming industry.

Key players in the Web3 gaming industry

Enjin, Axie Infinity, Forte, Immutable, Decentraland, Gala Games, The Sandbox, Gods Unchained, Sorare, Alien Worlds, Chain Games

Key developments in the Web3 gaming market:

- Sandbox partners with Warner Music Group to create a music-themed metaverse. The partnership will allow users to create and share music-themed experiences in The Sandbox, as well as to own and trade NFTs of their favourite songs and artists.

- Samsung is the newest multinational corporation to launch a Meta venture project, and it has chosen Decentraland as the platform for its metaverse.