With new releases, new projects, various awards and accomplishments, 2023 was a defining year for the Indian game development studios and publishers.

In a proud moment for the gaming industry, Gamitronics happened to be Indian Space Research Organisation’s (ISRO) official partner for Chandrayaan 2’s launch event. Nazara Technologies unveiled its new game publishing division – Nazara Publishing. Neela Mediatech’s gaming platform TMKOC Play announced a partnership with JioGames to roll out 50 plus games on the platform.

As the industry basked in these accomplishments, AnimationXpress delved deep into the pulse of Indian game development. Conversations with industry insiders revealed insights into the challenges, triumphs, and transformative moments that defined 2023. From navigating funding landscapes to innovating monetisation strategies, and from exploring market dynamics to understanding shifting player behaviors, Indian game studios embarked on a journey of introspection and growth.

2023 Projects

Gamitronics and its metaverse IP PartyNite on boarded long-term clients like Bangalore Airport, Rasasi Perfume, Dubai Gold Souk and more.

“We built our own GenAI and construction tool to let Meta-Architects, brands and corporates create and customise their own spaces,” said Gamitronics CEO Rajat Ojha. “We almost finished our metagame which will give enough reason to our [PartyNite metaverse] community to keep coming back to the platform regardless of events or campaigns.”

For JetSynthesys, 2023 was a most significant year. On the back of one of its successful games Real Cricket, the company launched its esports competition Global e-Cricket Premier League. It also launched Sachin Saga Pro Cricket, which – the company claims – saw a positive response from the players.

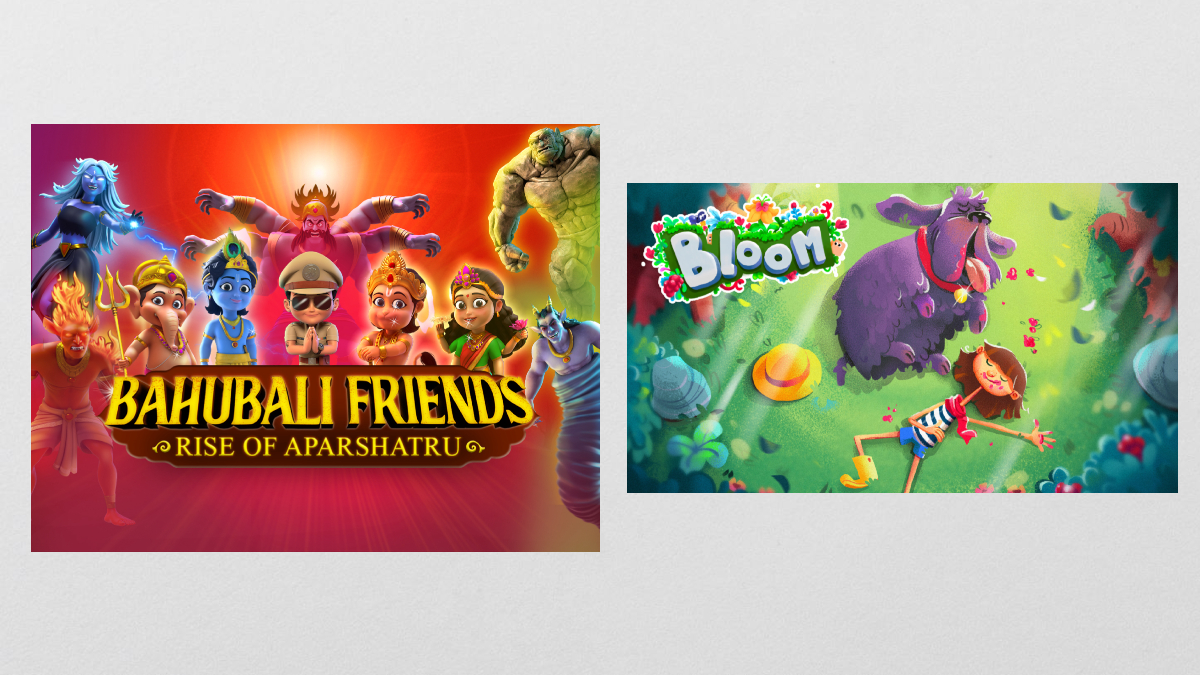

Indie gaming studio Lucid Labs’ founder Chirag Chopra said, “There’s no better way to put this, but 2023 was the best year for Lucid Labs yet. We released our most ambitious game Bloom – which is a puzzle adventure.”

Even for Hyderabad-based Ogre Head Studio, “2023 was a fantastic year,” said the studio founder Zain Fahadh. “We experienced significant strides, particularly with the steady progress on our project Yodha. Additionally, we successfully concluded work on another exciting undisclosed project.”

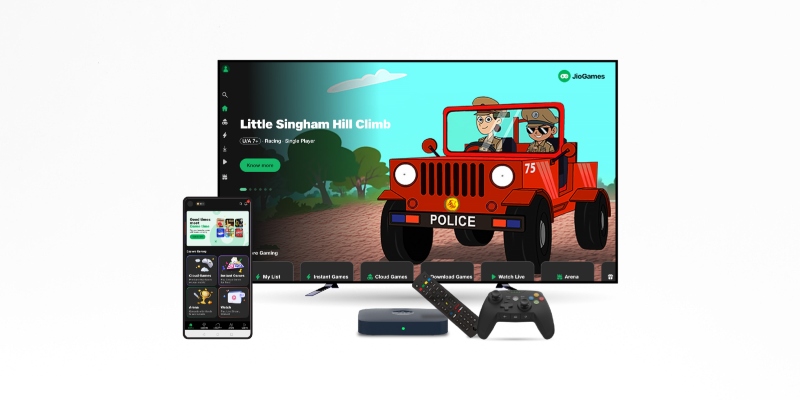

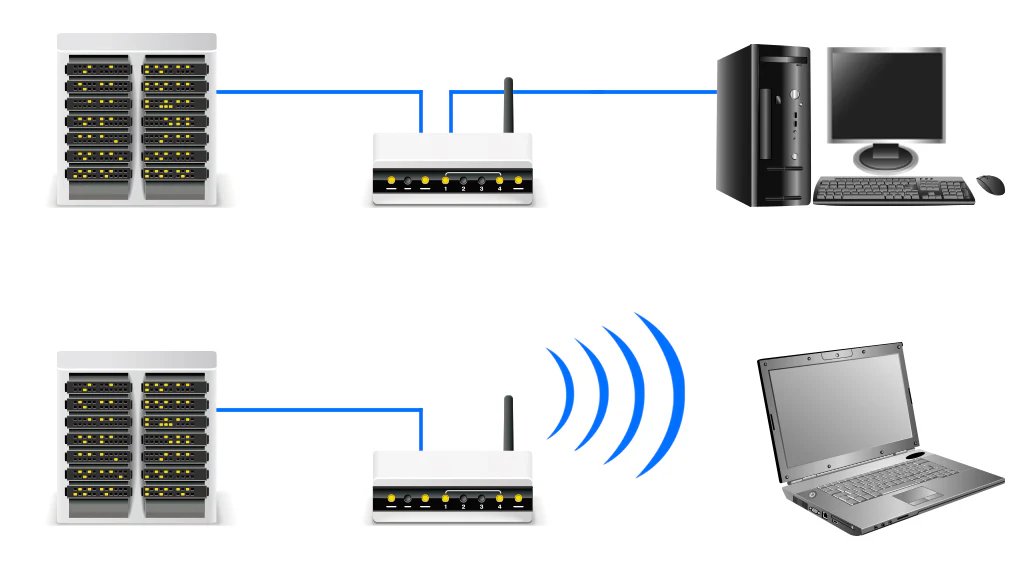

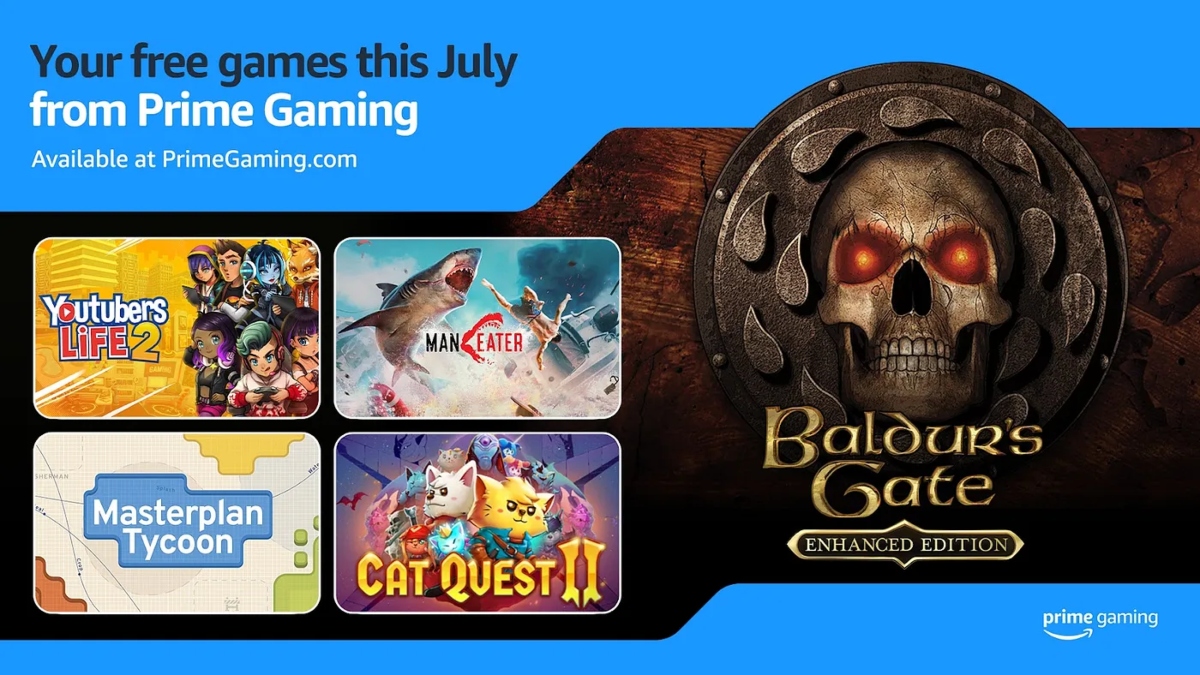

The JioGames app onboarded 1,064 games by the end of 2023, including a range of new games sourced from publishers like Disney and Green Gold Animation.

The company launched JioGamesCloud – its cloud gaming service – which transitioned from its beta stage to the subscription stage, with over 150 games from a variety of genres. It launched PowerPlay11 – a fantasy gaming platform where in the place of money, players can use JioGames’ in-app currency “Crowns” to participate in regular fixtures.

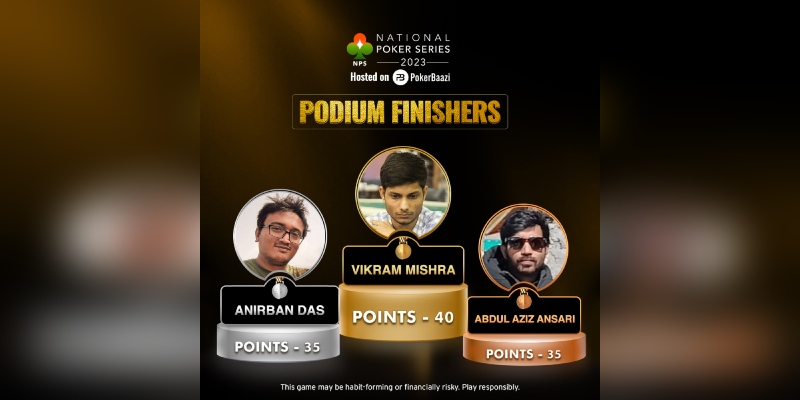

On its esports platform JioGamesEsports, the company hosted a cricket tournament. It also hosted an esports tournament featuring titles like BGMI and Valorant, with a Rs 20 lakh prize pool.

Achievements and awards

Gamitronics won awards globally and represented India in global events like Consensus and MDEC. “It’s a great feeling to be on those stages and finally having the story of India being put forward,” Ojha said. Ojha met with the president of India Draupadi Murmu. “Finally games are being appreciated at the highest offices of India and a ripped jeans wearing gamer and gamedev is welcomed everywhere.”

Lucid Labs’ newly built game Bloom received three awards at IGDC, including Mobile Game of the Year, Indie Game of the Year and Best Visual Art. “It was nominated for the Best Mobile Puzzle Game in PocketGamer Awards among some of the biggest mobile titles such as DC Heroes & Villains, Unpacking, and more,” Chopra shared.

“Jio Games reached a remarkable milestone with 10,000 creators onboard,” shared a JioGames spokesperson. “All of JioGames’ efforts culminated in the prestigious India Content Leadership Awards for gaming entertainment.”

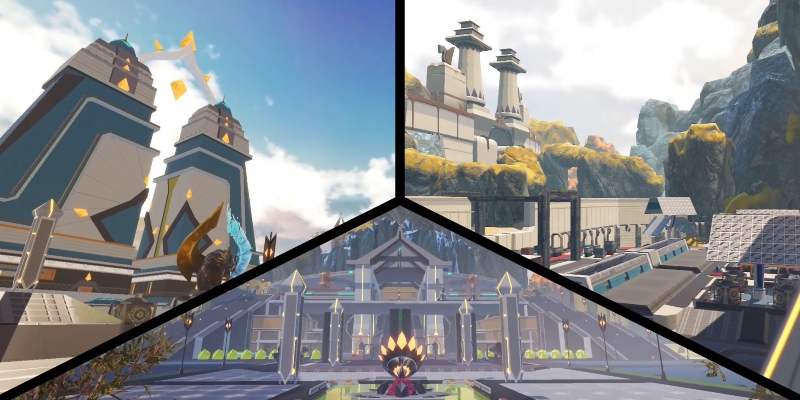

Indie studio SuperGaming hit eight million pre-registrations for its Indo-futuristic battle royale Indus and brought it to esports audiences through its playtests. “The feedback from esports pros, casters, and the community have helped shape Indus’ esports ecosystem and roadmap which we hope would allow us to give the nation’s talent a possible career path,” said SuperGaming communications manager Rishi Alwani.

Expansions, partnerships & collaborations

Gamitronics went global by increasing its footprint in the MENA region, Mauritius and Europe. “We multiplied our revenue by many folds compared to 2022 and opened various offices, most significantly in Dubai,” shared Ojha.

Jetsynthesys collaborated with venture accelerator company Brinc and Japanese holding company Digital Hearts Holdings.

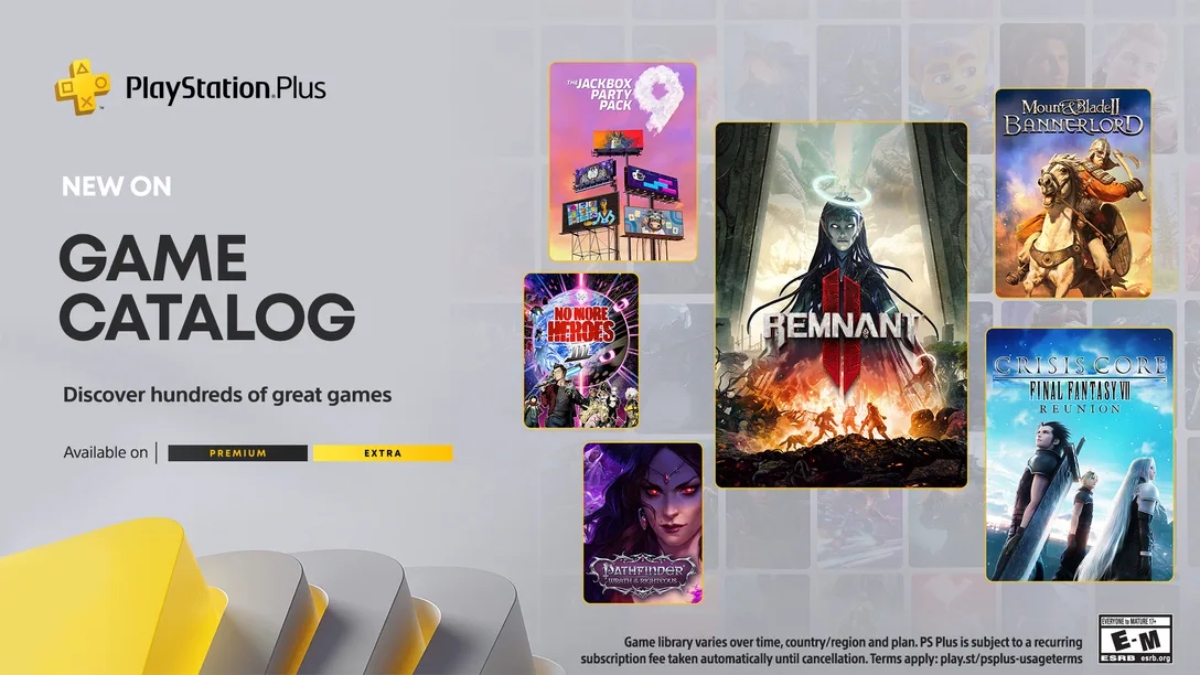

JioGames partnered with India LAN Gaming Season 4, Ampverse – College Rivals, Xiaomi, OnePlus and many other brands.

Game studio funding

Gaming studios feel that securing funds remained a challenge in 2023.

“The landscape was marked by its inherent difficulties, amplified by a competitive environment with a high volume of games being produced and released. This intense competition significantly contributed to the complexities associated with obtaining funding,” said Ogre Head Studio’s Fahadh.

According to JetSynthesys chief strategy officer Girish Menon, the downturn in funding in 2023 was influenced by global macroeconomic factors such as interest rate hikes, tightened liquidity, inflation, and recession concerns.

“However, looking ahead to 2024, there’s an optimistic outlook for a rebound in funding, as the industry adapts to these challenges and continues to capitalise on its growth potential,” said Menon. “The sector is expected to navigate the macroeconomic landscape effectively, attracting new investments and fostering development.”

Fahadh said, “The establishment of local bases by major platforms such as Xbox and Playstation in the country is a promising development. This move suggests an increased interest and investment in the Indian gaming industry, potentially opening up new avenues for funding. As these global giants set up a presence locally, it could create more opportunities for game studios to secure the financial support needed for the development of premium games. We remain optimistic about the changing dynamics and anticipate a more supportive funding landscape in the coming year.”

Monetisation models in free-to-play games

Industry players have listed the following monetisation models in free-to-play games in 2023:

- In-game advertisements: Display ads, video ads and rewarded ads are the primary revenue source for free-to-play games. “Ads are a key medium for brands seeking to connect with gamers,” said Menon. “Here, we are seeing deeper brand integrations and collaborations with endemic and non-endemic brands.”

- In-app purchases (IAPs): This is the most prevalent model, offering a free-to-play experience with optional purchases for virtual goods like cosmetics, boosts, additional levels, and characters. “Although it usually makes up a smaller part of earnings, player interest has been rising recently. A Niko Partners report states that 31 per cent of users make in-game purchases now in India,” explained Menon. The JioGames spokesperson added, “As per reports, out of the estimated 507 million gamers, 120 million have paid for availing multiple services including in-game purchases.”

- Subscription services: Tiered subscriptions granting access to exclusive content, faster progress, or ad-free experiences are gaining traction, said the JioGames spokesperson.

- Esports sponsorships: Popular games in the esports scene attract sponsorships from brands seeking engagement with the dedicated esports audience.

- Others: Live events, collaborations, and limited-time offers have also become effective in driving revenue.

“In the future, we might see a shift in monetisation strategies when Web3, metaverse and blockchain games gain momentum,” said the JioGames spokesperson.

So how do studios balance monetisation and player experience?

For Lucid Labs, that is a mix of user testing and localised pricing. “[Our game] Bloom boasts a cleverly designed freemium model, where players can play all the levels without spending a dime through minimal ads or make a one-time affordable purchase to remove all ads,” said Chopra. “We regularly tweak and experiment with the IAP pricing to ensure we stay within the desired range, and the game flow is crafted to convey the value of IAPs via content and polish.”

JetSynthesys’ Menon shared, “Our approach involves offering optional in-app purchases, ad-based monetisation models, and innovative partnerships that enhance rather than disrupt the gaming journey.” Monetisation through commerce is also starting to see traction in India, with a growing interest around merchandising, he added.

“JioGames leverages free-to-play models with in-app purchases that resonate with the spending habits of Indian gamers, ensuring accessibility without compromising quality. Moreover, the integration of culturally relevant themes, popular game characters and engaging events enhance user engagement and retention,” said the company’s spokesperson.

Market growth and player engagement

“The Indian gaming industry has enjoyed a phenomenal year in 2023, undergoing significant evolution in both market growth and player engagement as well as consumption of gaming content,” said the JioGames spokesperson.

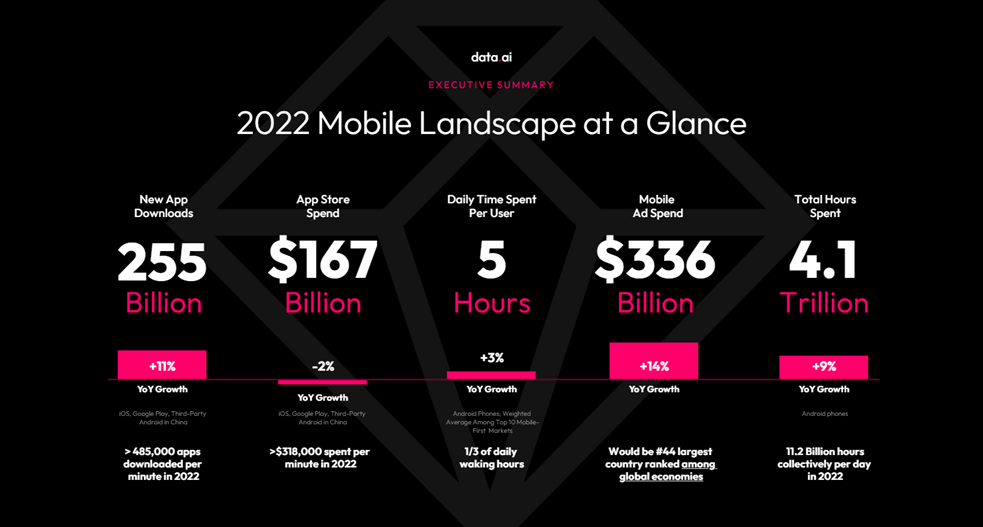

Estimates suggest that India has around 520 million gamers currently and this number is projected to increase to 600–650 million by 2027 (as per Niko Partners, Statista), said JetSynthesys’ Menon. The Indian gaming market soared 67 per cent to $3.9 billion, driven by mobile dominance (85 per cent share) and an esports boom, revealed the JioGames spokesperson.

Menon too echoed this trend: “The industry’s value is poised to reach ~$1.6 billion by 2027 (as per Niko Partners), primarily driven by mobile device adoption. Notably, esports gained recognition from the government, with its inclusion in multi-sport events.”

The growth in the free-to-play mobile gaming segment does not seem to stop anytime soon, said Nodding Heads co-founder, game designer and project manager Avichal Singh. The Pune-based studio’s PC and console game Raji: An Ancient Epic came to mobile on the Netflix app in 2022, and has been well received through 2023. “This [mobile gaming] market is expanding at a fast pace and there’s opportunity to reach more and more players.”

“Additionally, there was an increase in average time spent on gaming and participation from both endemic and non-endemic brands, showcasing a deepening engagement and a diversified interest in the gaming sector,” Menon said.

“The Indian gaming industry’s future looks bright. With its fast-growing market, engaged player base, and increasing investment, India is poised to become a major global gaming hub in the coming years,” said the JioGames spokesperson.

Game development and player behaviour

“In 2023, the Indian gaming market trends showed a continuing interest in mid-core and hardcore gaming, alongside the use of AI, AR/VR technologies for personalised and immersive experiences. Game developers increasingly focused on localising content to reflect cultural nuances and narratives, appealing to the diverse young Indian audience,” said Menon.

Industry veterans listed the following player behaviour trends:

- Players engaged in complex, online multiplayer and competitive games over single-player experiences, seeking social interaction

- Focus on regional themes and languages: Players are looking for games that feature relatable stories, are culturally relevant and narrative-driven.

- Players look for streamers who talk in their local language.

- Indians are spending more on gaming, both in terms of in-app purchases and upgrading devices. The average revenue per paying user (ARPPU) is steadily increasing.

JioGames shared some game publishing trends:

- Mobile is king: India remains a mobile-first gaming market, with 97 per cent of players accessing games on smartphones and tablets. Publishers are focusing on mobile-friendly genres like battle royale, casual and hyper-casual games.

- Rise of Indian studios: Local game developers are making a mark with innovative titles catering to Indian tastes and preferences. Games like Ludo King and Raji: An Ancient Epic achieved global success.

- Esports on the rise: Esports viewership and participation are growing rapidly, attracting major investments and sponsorships from global publishers. Tournaments for games like BGMI, Valorant, and Call of Duty Mobile are gaining traction locally and internationally.

Conclusion

“Overall, 2023 was a year of remarkable growth and positive changes for the Indian gaming market. The industry is expected to continue its upward trajectory in the coming years, fueled by technological advancements, diverse content, and evolving player preferences,” summed up the JioGames spokesperson.

This is the first part of our three-part gaming yearender series.